Whether you are married or single; whether you have adult or minor children or no children, having a comprehensive and well thought-out estate plan is the smart thing to do and is always in yours and your families' best interests.

Read MoreEstate planning is the process of arranging, during a person's life, for the management and distribution of that person's estate during the person's life and at and after death, while minimizing any tax consequences. Not all estate plans are created equal and should be specific to each person, couple, or family and tailored to their unique needs. Estate planning is one of the most important steps any person can take to make sure that their final property and health care wishes are honored and that loved ones are provided for in their absence. This should include financial planning and guardian designations for any minor children as well.

Unfortunately, many people postpone even rudimentary estate planning decisions because of common misconceptions based on prevalent estate planning myths. As an experienced Michigan estate planning lawyer, Mathew Abraham often receives calls from people after they have already experienced the consequences of inadequate estate planning that results in frustrated intentions, unnecessary probate, personal family turmoil, or tax expenses and loss of control of health care decisions. This article is intended to dispel some common myths about estate planning to help promote better planning and decision-making.

Read MoreWhile estate planning objectives and the best options for achieving those goals can vary dramatically, all adults can benefit from at least a simple estate plan. A range of factors might dictate an individual’s specific estate planning needs, such as a simple will, living trust, financial power of attorney, advance health care directive and more. Unfortunately, many people postpone even rudimentary estate planning decisions because of common misconceptions based on prevalent estate planning myths. As an experienced Michigan estate planning lawyer, Mathew Abraham often receives calls from people after they have already experienced the consequences of inadequate estate planning that results in frustrated intentions, unnecessary probate, personal family turmoil, or tax expenses and loss of control of health care decisions. This article is intended to dispel some common myths about estate planning to help promote better planning and decision-making.

Read MoreBenjamin P. Hardy contributed an article to Inc.com that I believe might be one of the most insightful articles I've read this year. We all know much written by Mr. Hardy in this article to be true. Take a read and see for yourself. It may just give you a clearer perspective to move you forward in your endeavors, whatever they may be.

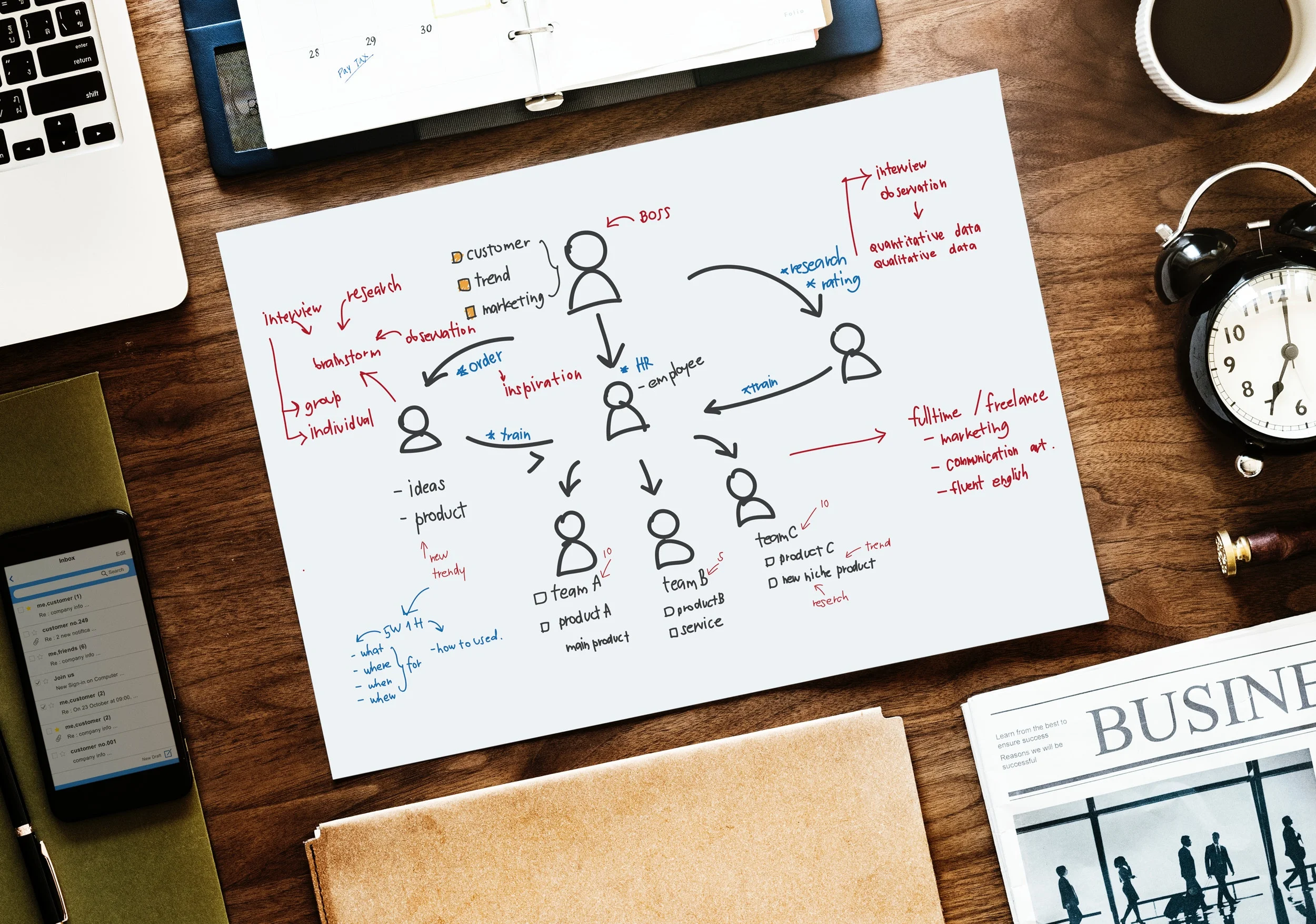

Read MoreIf you want to make your startup a success, the first thing you need to do is get into the right mindset. This might be your first venture, or you may be a veteran at launching new businesses—it doesn’t matter.

The fact is this: It’s easy to become the biggest obstacle to your own success. Your thoughts and your emotions can hold you back and get the better of you. If you don’t go into the office every single day in the right frame of mind, you’re going to end up making bad decisions.

You need to focus on what really matters if you want your startup to grow fast and succeed. Here’s what you need to focus on if you want your mindset to be a strength rather than a weakness.

Read MoreTime to update: Make sure your estate plan documents fully support your interests and those of your heirs.

An estate plan is like a car or a house: It needs regular maintenance to function as intended. Yet unlike your car or home, external events can create the need for adjustments. Among such events is legislation like the tax bill Congress passed in late December.

So this is an important time to schedule a meeting with your estate planner and be certain your plan is up-to-date. Even if your estate plan won’t be affected by the new tax law, it’s smart to confer with your estate planner periodically to be certain your current wishes are reflected in your estate planning documents.

Read MoreThe Value of Setting up a Trust for Your Children

The thought of your minor children growing up without you is enough to bring a lump to any parent’s throat. You plan to be with your children to see them grow and enjoy life, but what if something happens to both you and your spouse? You have hopefully planned to leave money for your children through life insurance. What about who would become their legal guardian? If you have significant life insurance and/or assets, your minor children could become wealthy overnight. How would they handle that responsibly?

The answer is that they would need help.

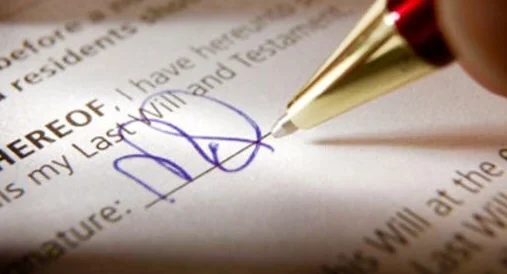

You can take one critical step now to empower yourself to have a say in how your children are raised, no matter what. By creating a will with a trust component, you will be able to choose who acts as a caretaker for your children, who handles their finances and how the assets should be distributed to reflect your wishes.

Read MoreBankruptcy Basics

For many individuals, filing for bankruptcy relief can provide a way out of debt and a fresh financial start. But whether or not a bankruptcy filing is in your best interest depends on many factors and your individual circumstances. Read on to learn more about what to consider if you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Read MoreBy: Matthew J. Abraham, Esq., Michigan Estate Planning Attorney

When families lose a loved one, the emotional stress and grief can make it difficult to focus on financial issues. Unfortunately, surviving family members might need access to assets of a breadwinner’s estate to provide for their basic financial needs like the home mortgage, school tuition, utility bills and even basics like groceries. When the assets of an estate are tied up in probate, the value of the estate can be diminished substantially, and access to money can be delayed for months or even years if the estate is subject to a contested probate proceeding. These are just a few reasons that most people try to avoid the probate process. While the probate of a will can raise significant issues, such as probate costs, delays in distributing residual assets and privacy violations, the situation can be far more problematic when an individual dies with no will or trust at all.

Read MoreWhy a Basic Estate Plan is Necessary — At Any Age

By: Matthew J. Abraham, Esq., Michigan Estate Planning Attorney

“At what point do I need to create an estate plan?”

“When should I at least setup the basic documents that will help my family make important decisions in the face of an unexpected life-changing event?”

“What estate planning documents do I really need to create?”

“Where do I even start?”

We as individuals and families face so many estate-planning questions that it can be prohibitive to taking any action at all. Very often these important questions simply go unanswered or even ignored altogether with no estate-planning action being taken by individuals and families to protect themselves and their loved ones. And yet, taking action is exactly what needs to be done before it becomes too late. Having experienced estate-planning counsel and advice from an attorney specializing in your state’s probate law is important to begin addressing these issues and determining the best course of action for you and your family.

Read MoreMichigan Business Entities- The Limited Liability Company (LLC)

April 29, 2015 in business, LLCs, Limited Liability Company

BUILD YOUR BUSINESS ON A SOLID FOUNDATION

Many startup companies, entrepreneurs, self-employed businesses, and developing organizations are choosing to organize and form LLCs as opposed to traditional corporations because the LLC is typically cheaper to form, less expensive to maintain and operate, has more options with four choices of federal income taxation, and has fewer annual filing and recording formalities than corporations. It is important that you build a solid foundation upon which to launch your business endeavor. Take the right steps by consulting with an experienced business attorney to make sure you are building a solid foundation upon which to launch or expand your vision.

Contact Abraham | Law to get your business off the ground the right way by setting up your Michigan LLC today.

If you have questions about starting a Limited Liability Company, you should contact LLC and corporate business attorney Matthew Abraham or call 810.750.0440 and determine the best business strategy for you.

Read More

So What Type of Business Entity Do I Need?

This is the first question to ask and answer when preparing to engage in or launch a new business venture and even when forming an entity for an established business. While there are many benefits of forming a limited liability company (LLC), it is important to understand why you should consider forming an LLC over other available types of entities for your business.

Read More

Michigan Estate Planning Attorney

Protecting Your Legacy and Your Loved Ones

Estate planning is an important process designed to ensure your loved ones are cared for after your death and your final wishes are carried out. Many people loathe discussing the topic of estate planning, but the reality is that estate planning encompasses more than just death and taxes. Estate planning allows you to leave a legacy for your heirs, which for many is ultimately the most important thing in life.

Despite the common recognition as to the import of estate planning, nearly half of all Americans today do NOT have an estate plan

Read More

![Michigan Estate Planning Lawyer Debunks Estate Planning Myths [Part 2]](https://images.squarespace-cdn.com/content/v1/5373da14e4b0f28da14bd6e6/1538223001357-Y6PLHOCBAGHS5F38AJSW/Planning-estate-goal-matthew-abraham-law.jpg)

![Michigan Estate Planning Lawyer Debunks Estate Planning Myths [Part 1]](https://images.squarespace-cdn.com/content/v1/5373da14e4b0f28da14bd6e6/1538222091129-BG7LF3I58QS7BU84TY2N/Planning-estate-matthew-abraham-law.jpg)